Forex trading, also known as foreign change trading, requires the getting and selling of currencies on the international trade market with the aim of making a profit. It is the biggest economic industry internationally, with an average everyday trading quantity exceeding $6 trillion. Forex trading presents investors and traders the ability to suppose on the fluctuation of currency prices, allowing them to perhaps benefit from improvements as a swap prices between different currencies.

Among the critical features of forex trading is its decentralized nature, since it runs 24 hours each day, five days a week across different time areas worldwide. This supply allows traders to participate on the market anytime, giving ample options for trading around the clock. Additionally, the forex market is very fluid, meaning that currencies are available and offered rapidly and simply without considerably affecting their prices.

Forex trading requires the utilization of influence, which allows traders to control bigger positions with a lesser amount of of capital. While leverage can improve gains, it also raises the chance of deficits, as actually little changes in currency prices can result in substantial gets or losses. Thus, it is needed for traders to manage their chance cautiously and use ideal risk administration methods, such as placing stop-loss instructions and diversifying their trading portfolio.

Furthermore, forex trading provides a wide variety of trading methods and methods, including complex analysis, essential analysis, and message analysis. Specialized evaluation requires understanding traditional cost information and using numerous signs and information styles to spot developments and predict potential cost movements. Fundamental examination, on another give, targets examining financial indicators, information activities, and geopolitical developments to assess the intrinsic value of currencies. Message analysis involves gauging market belief and investor conduct to foresee changes in industry sentiment.

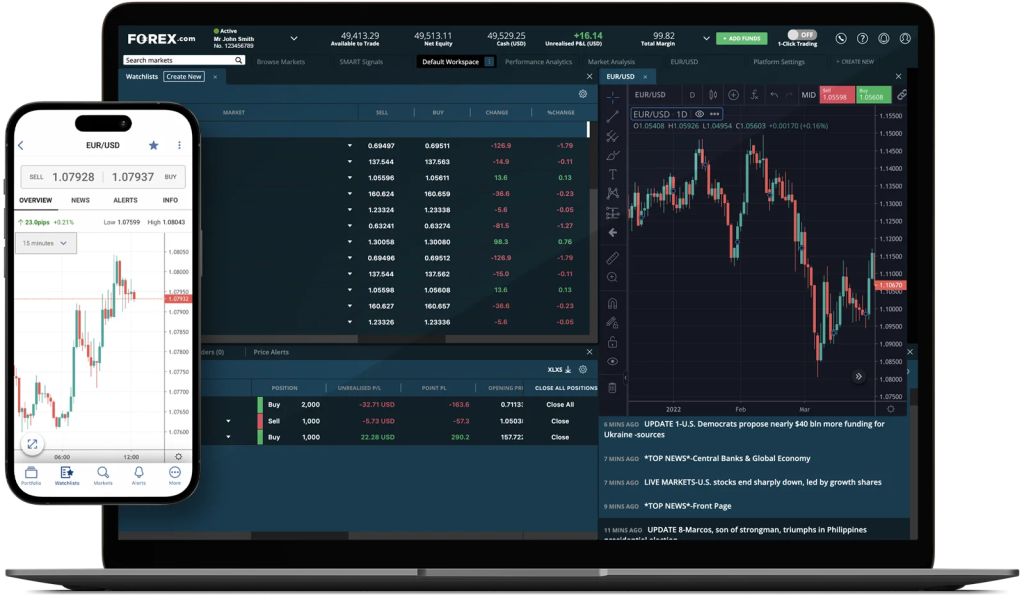

Moreover, breakthroughs in engineering have altered the landscape of forex trading, which makes it more accessible and successful than actually before. On line trading platforms and portable apps let traders to execute trades, entry real-time industry knowledge, and monitor their positions from anywhere with a web connection. Furthermore, automated trading techniques, such as for instance specialist advisors (EAs) and trading robots, can execute trades quickly based on pre-defined criteria, removing the need for information intervention.

Despite its prospect of revenue, forex trading bears inherent risks, and traders should be familiar with the problems and issues related to the market. Volatility, geopolitical functions, and sudden industry actions may cause significant failures, and traders must forex robot anticipate to manage these risks accordingly. Also, cons and fraudulent actions are prevalent in the forex industry, and traders must workout caution when choosing a broker or investment firm.

In summary, forex trading provides a active and potentially lucrative opportunity for investors and traders to take part in the world wide currency markets. With its decentralized nature, large liquidity, and supply, forex trading is now increasingly common among individuals seeking to diversify their expense portfolio and capitalize on currency price movements. However, it is required for traders to instruct themselves about the market, produce a strong trading strategy, and practice disciplined chance management to succeed in forex trading over the extended term.