Forex trading, also called international exchange trading or currency trading, is the international marketplace for buying and selling currencies. It runs 24 hours each day, five times weekly, allowing traders to participate available in the market from everywhere in the world. The primary purpose of forex trading would be to profit from variations in currency trade charges by speculating on whether a currency pair will rise or fall in value. Individuals in the forex industry include banks, financial institutions, corporations, governments, and personal traders.

One of the key options that come with forex trading is their large liquidity, meaning that large volumes of currency are available and offered without considerably affecting exchange rates. That liquidity ensures that traders may enter and quit roles rapidly, allowing them to make the most of actually small cost movements. Additionally, the forex industry is very accessible, with minimal barriers to entry, enabling individuals to start trading with somewhat small levels of capital.

Forex trading offers a wide selection of currency pairs to deal, including major couples such as EUR/USD, GBP/USD, and USD/JPY, along with minor and exotic pairs. Each currency set shows the trade charge between two currencies, with the initial currency in the set being the bottom currency and the next currency being the quote currency. Traders can benefit from both climbing and falling areas by using extended (buy) or short (sell) roles on currency pairs.

Successful forex trading takes a stable comprehension of simple and specialized analysis. Essential examination requires considering economic indicators, such as fascination rates, inflation charges, and GDP growth, to gauge the main energy of a country’s economy and their currency. Technical analysis, on another hand, involves studying price graphs and styles to spot styles and possible trading opportunities.

Risk administration can also be important in forex trading to safeguard against possible losses. Traders frequently use stop-loss instructions to restrict their disadvantage risk and use proper place dimension to make sure that not one industry may considerably affect their over all trading capital. Moreover, maintaining a disciplined trading strategy and handling feelings such as for instance greed and concern are essential for long-term achievement in forex trading.

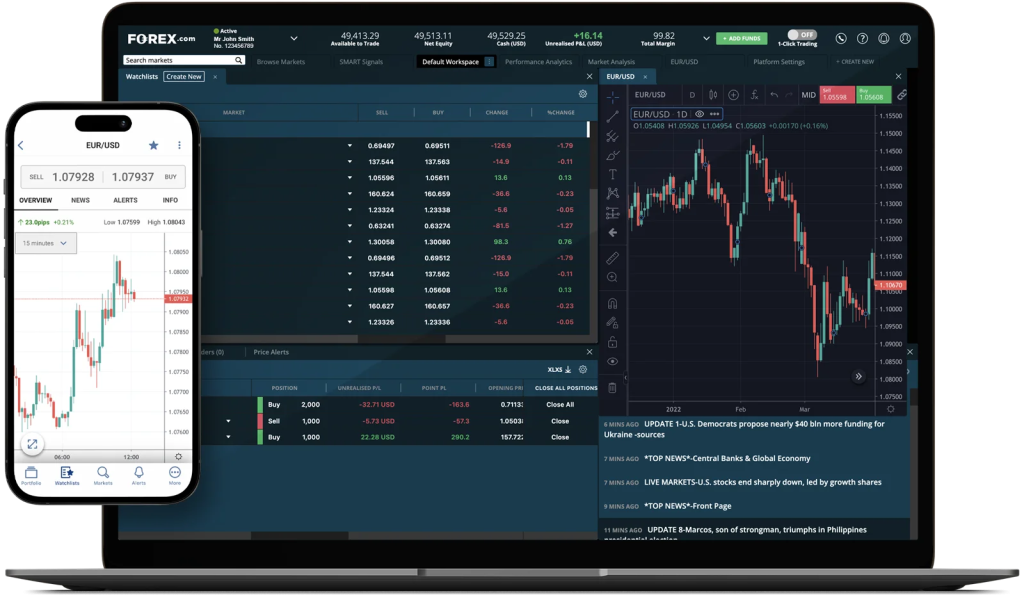

With the growth of technology, forex trading has be more available than ever before. On the web trading platforms and cellular apps provide traders with real-time use of the forex industry, allowing them to implement trades, analyze industry data, and handle their portfolios from any device. Moreover, the option of academic forex robot sources, including guides, webinars, and demonstration reports, empowers traders to develop their abilities and boost their trading performance around time.

While forex trading presents significant revenue potential, additionally, it carries inherent dangers, such as the potential for significant losses. Therefore, it is required for traders to perform complete study, create a noise trading strategy, and continually check market problems to create informed trading decisions. By staying with disciplined risk management methods and remaining informed about worldwide financial developments, traders may enhance their odds of success in the active and ever-evolving forex market.